25th November, 2009

Dear patient readers of this blog…please find below my latest Huff Post post.

Some may wonder why I cheered when White House Chief of Staff Rahm Emanuel announced that the president plans to cut the deficit, because he “does not want to keep on adding to the debt.”

It’s no secret that conservative economists believe that the way to cut the deficit is to cut government spending. In other words, government must manage the federal budget in the same way that you manage your household budget.

But in truth, the president must do the opposite.

To strengthen the levees against the rising tide of debt and the “hurricane of unemployment,” the president must both spend down the debt with a bigger fiscal stimulus, and also get a grip on monetary policy — regulating lending and keeping interest rates low for all of us, not just the banks.

Third, the administration must manage government debt effectively and not leave it to the self-serving and private financial markets.

I am surprised at how often I have to explain why the fiscal stimulus is so important. But because fiscal conservatives just don’t get it, they must be reminded of the well documented evidence again and again.

Government spending, unlike private spending, will pay down the debt by generating income, including tax revenues, and by reducing welfare payments. For unlike private households, governments generate revenues when they spend or invest, particularly on projects at home.

When a household spends its savings on say, a new wind turbine, solar panels for the roof, or insulation, money drains away from the household bank account. The engineers, builders and laborers that construct the turbine don’t pay money back into the householder’s bank account — regrettably.

By contrast, when the federal government invests in jobs that can’t be exported to China, the engineers, builders and laborers employed pay taxes back into the government’s account. They then spend the balance of their incomes in shops and businesses, and these pay taxes too. Indeed the spending might stimulate a small business to invest and hire, adding even more taxpayers paying back into the government’s account.

It’s called the multiplier effect because guess what? It multiplies government revenues. The evidence shows that the increase in revenues outweighs the spending and thus helps cut government debt.

However, it’s not enough to spend away government debt. More must be done, (and this is where Paul Krugman and I part company).

If the president is really determined to not “keep on adding to the debt,” then he must tackle monetary as well as fiscal policy. As John Maynard Keynes repeatedly emphasized, monetary policy must always precede and underpin fiscal policy. They go together like a horse and carriage — you can’t have one without the other.

It is not enough to use public funds to bail out the economy, while at the same time allowing the private banking sector to arbitrarily raise interest rates for government, commercial and household borrowing.

It’s particularly not fair — indeed it’s downright immoral — that the private banking sector is reaping such rich pickings from low rates set by the Federal Reserve; from the struggling body that is the US economy, and from government borrowing.

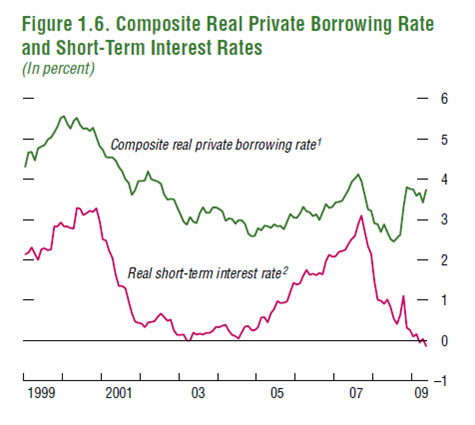

For proof of the bankers’ rich pickings, study the chart below from the International Monetary Fund. It shows (in pink) the low rates of interest paid by banks to the Fed and other central banks, in contrast to the rates of interest (in green) that the banks then charge to companies, households and individuals.

Note how the rates for those of us active in the real economy are always higher than they are for bankers borrowing direct from the Fed and/or central banks.

Then note how much they diverge after 2008. Bank borrowing costs fall to nothing, while private borrowing costs soar. No wonder bank profits are ballooning.

(The chart is from the IMF’s October 2009 Global Financial Stability Report. The composite real private borrowing rate [RPBR] is a GDP-weighted average of the U.S., Japan, euro area, and U.K. RPBRs.)

The Treasury must get a grip on high rates of interest — rates bankrupting businesses and homeowners, causing foreclosures and unemployment to rise — all “adding to the government debt” by increasing welfare spending.

The administration (through the Treasury, the Fed and the banking system) must adopt policies to force down rates across the spectrum, for government and the private sector; for the commercial and household sector as well as banks; all loans, short-term and long-term, safe and risky.

To stop “adding to the debt” it is vital to keep interest rates very low — while ensuring that lending is ‘tight’ — i.e. well regulated. Today, in the midst of the crisis, money is tight, and it is expensive.

Above all the Treasury must get a grip on its own debt management — and not leave that to the private, self-interested finance markets.

Because after all, bankers have one great way of making capital gains: by “adding to the debt.”

I understand your point (thank you) but I think it would be clearer to say that government must invest in the economy to generate tax

returns that pay down debt. Use of the verb “spend” weakens and confuses the argument you make.